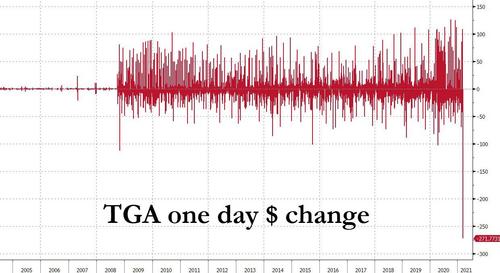

The Fed is buying securities worth $120 billion from them each month, aggregate household savings are $1 trillion above pre-COVID levels, and money-market funds are brimming, with assets $700 billion above pre-pandemic levels. In a nutshell, we’re talking about even more inflation pumped into an already inflationary environment.Īccording to the Reuters‘ report, US banks are already awash with cash. US money market and short term debt market participants are knee-deep in liquidity.” A JPMorgan official told Reuters this will increase liquidity even further.įewer bills mean more cash looking for a home in liquidity land. Banks often use these as collateral for repo borrowing and hedging derivative trades. The drawdown in the TGA also means the US Treasury will be selling fewer Treasury bonds. In other words, the Treasury is about the blow the asset bubbles even bigger. And at least some of this money is going to find its way into the marketplace. That means Bank of America has more money to lend or invest in financial markets.Ĭredit Suisse called the planned drawdown of the Treasury’s Fed account as a “tsunami” of cash into depositary bank reserves. The Fed debits the US government’s TGA account and credits Bank of America’s account at the Fed. For illustrative purposes, let’s say somebody deposits their government check at Bank of America. When individuals or businesses receive a government check, they deposit the money in their bank account. The account balance is so high now because the government has borrowed, but the accumulated money hasn’t been spent yet. According to Reuters, the balance has rarely exceeded $400 billion and before 2016, it was never above $250 billion. The balance in the TGA is four times bigger than it was a year ago. The amount of cash in that account has skyrocketed in recent months as the Treasury has borrowed to pay for the massive stimulus spending authorized by Congress. The TGA holds funds coming into the federal government from both taxes and the sale of Treasury bonds. According to the announcement, the Treasury plans to cut the accounts balance in half by April and draw it down to $500 billion by the end of June as the Biden administration ramps up spending even more in the coming month. The Treasury plans on drawing down the $1.6 trillion balance in its Treasury General Account (TGA) at the Federal Reserve. In other words, another tidal wave of inflation. And a move recently announced by the US Treasury Department will mean even more money flooding into the marketplace. The Federal Reserve increased the money supply at a record rate in 2020.

Buying Gold & Silver with Cryptocurrency.Buy Gold the Ultimate Monetary Insurance Policy.

0 kommentar(er)

0 kommentar(er)